And Our Outlook for 2023.

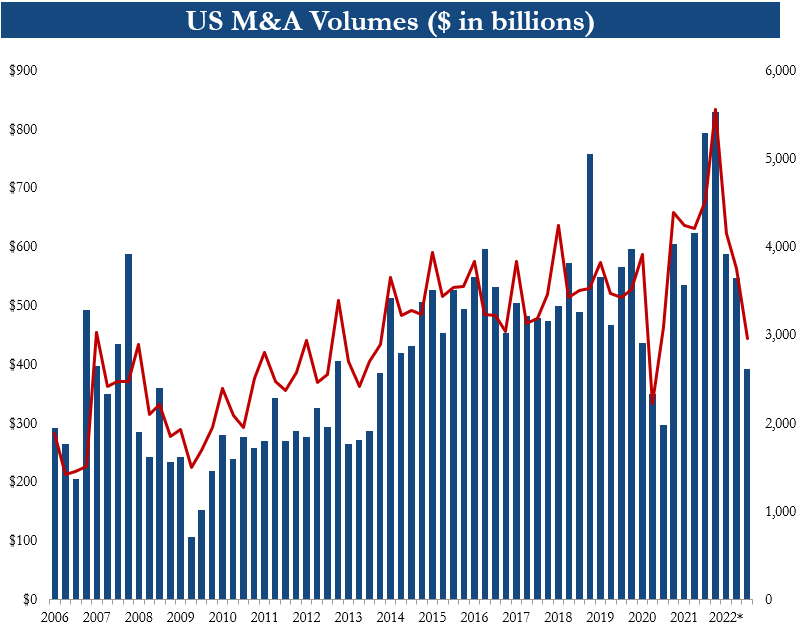

This year we saw the pandemic come to end; we saw war break out in Ukraine; we experienced significant supply chain disruption; and we saw interest rates increase following significant inflation. The confluence of all of these dynamics led to a significant contraction in M&A deal volumes. Essentially a large number of buyers and investors either chose not to pursue acquisitions with this backdrop or they tried to re-price / lower valuations to reflect the higher interest rates and greater uncertainty, resulting in sellers choosing not to pursue a sale of their business or not accepting lower deal terms.

Reasons to be optimistic despite the recent pullback…

U.S. M&A volumes dropped precipitously this year. In Q3 of 2022, volumes were off more than 50% from the prior year. We expect Q4 to be down year over year though not as extreme as Q3. We look at the recent midterm election results bringing a more moderate and less volatile political backdrop. Moreover, we have observed inflationary pressures abating somewhat, which will help temper the rising interest rates.

We would also point out that after every pullback, there tends to be a sharp rebound. We expect 2023 to be no different.

New Capital Raised…A Gauge of Investment Confidence

Fortunately there is still strong appetite to invest in private businesses across the U.S.

New private equity capital raised is a very important benchmark that we use to measure the confidence in future deal flow. As new capital is raised, particularly when the total quantum of capital raised is at or near record levels, this sends a very strong signal that institutional equity investors are interested in making large bets in private businesses.

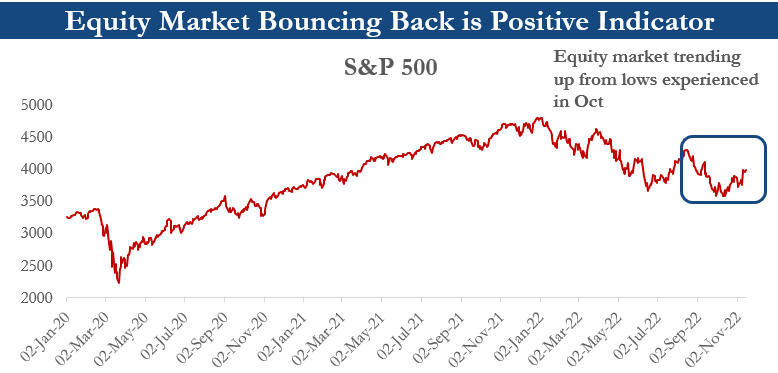

The Bulls Are Getting Back Into The Equity Market

While there is still quite a ways to go yet, it is very positive that the equity market is marching on the recovery path. In periods of strong equity market performance, we typically see rising M&A volumes, as target businesses become satisfied with their share price and receptive to takeover talks.

This then spills over into the private market…As public competing and comparable companies consummate M&A transactions, we see private companies following suit.

There is no question this year has been volatile and tough on equity valuations. M&A activity tends not to thrive with this backdrop and so it was not surprising to see volumes decline as a result. However, we are very optimistic that we are finishing this year on a high note and we believe history will once again prove that it tends to repeat itself, and we will see a healthy level of M&A transactions in 2023.